Resources

Featured blog Post Title Goes here

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Investing in a Senior Housing Syndication with a Roth IRA

Senior housing syndications have become increasingly popular among investors seeking stable returns and diversification in the real estate sector. A syndication allows a group of investors to pool their capital

Navigating the World of Senior Living Investments: A Comprehensive FAQ

The landscape of real estate investment is diverse, but one sector that’s gaining attention, thanks to demographic shifts, is senior living. Whether you’re a seasoned investor or new to the

Why Texas Is a Top State for Investing in Senior Housing

The senior housing market is rapidly evolving, with demand outpacing supply in many regions across the United States. Among the top states capturing investor attention, Texas stands out as a

Supply vs. Demand Imbalance in Senior Living Development and Investment

In 2025, demand for senior housing is surging and supply is constrained due to financing challenges, rising construction costs, and labor shortages. Given these factors, the best way to navigate

Georgia: A High-Growth Market for Senior Housing Investment

Georgia has become one of the fastest-growing states for retirees, thanks to its affordable cost of living, mild climate, and strong healthcare infrastructure. As the senior population continues to grow,

Tennessee: A Prime Destination for Senior Housing Investment

Tennessee has emerged as a top choice for retirees due to its affordability, no state income tax, and growing senior population. With increasing demand for independent living, assisted living, and

Why Florida is a Prime Market for Senior Housing Investment

Florida: The Premier Destination for Senior Housing Investment Florida has long been recognized as a top retirement destination, attracting seniors from across the country with its warm climate, tax advantages,

Nevada: A Growing Market for Senior Housing Investment

Nevada is emerging as a top destination for retirees, driven by its low taxes, affordable living costs, and warm climate. With a rapidly expanding senior population, the demand for independent

Arizona: A Thriving Market for Senior Housing Investment

Arizona has become one of the fastest-growing retirement destinations in the United States, offering a combination of warm weather, affordable living, and a thriving healthcare infrastructure. As the demand for

South Carolina: A Thriving Market for Senior Housing Investment

South Carolina is becoming one of the most attractive retirement destinations in the U.S., driven by its warm climate, affordability, and coastal appeal. With a rapidly growing senior population, the

Why Colorado is an Ideal Market for Senior Housing Investment

Colorado: A Prime Destination for Luxury Senior Living Investment Colorado’s high quality of life and health-conscious culture make it a premier location for upscale senior housing investments. As the state

North Carolina: A Rising Star in Senior Housing Investment

North Carolina has emerged as a top destination for retirees, offering a mild climate, affordable living, and a high quality of life. As the state’s senior population continues to expand,

Investing in Senior Housing Located in Opportunity Zones: A Tax-Efficient Opportunity

The aging population in the United States continues to drive demand for senior housing, making it an attractive investment sector. When this investment intersects with Opportunity Zones, the potential for

The Case for Alternative Investments Using Self-Directed IRAs

For millions of Americans, retirement savings are deeply tied to the stock market, with the promise of growth overshadowed by market volatility. As of 2023, U.S. households collectively held over

The Financial & Tax Benefits of Investing in Senior Housing Real Estate

Behind Haven Senior Living Partners’ (HSLP) operations is an abundance of financial savvy and strategy. As an investor, it’s essential to understand what happens when subscribing to an investment. For

Investing in Senior Housing: Your Path to Impact

Guiding Investors. Transforming Senior Housing. Creating a Lasting Impact. At Haven Senior Living Partners, we understand that investing in senior housing is more than just a financial decision—it’s a mission-driven

Investing in Real Estate Syndications: Unlock Passive Tax Benefits in 2025

For high-net-worth individuals, real estate syndications present a compelling opportunity to diversify their investment portfolios while reaping a host of financial advantages. Among the most powerful benefits are the passive

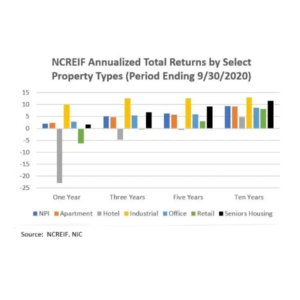

Why Investor Interest in Senior Housing is Soaring in 2025

In 2025, investor interest in senior housing is experiencing an unprecedented surge. A combination of demographic shifts, economic factors, and evolving care models is driving this market to new heights.

$1 Trillion in Investment Needed in Senior Housing by 2050

With a rapidly aging population and evolving expectations, the senior housing industry faces a critical demand for 775,000 new units by 2030. If current development rates continue, the shortfall could

The U.S. Senior Living Market: Trends, Challenges, and Opportunities

Executive Summary The U.S. senior living market is undergoing rapid evolution, driven by demographic shifts, economic factors, and changing consumer expectations. As the baby boomer generation transitions into retirement, the

Opportunity Zones: Catalyzing Investment in Senior Housing

The United States faces a persistent and acute shortage of affordable housing, especially in low-income communities, where attracting meaningful investment has historically been challenging. Senior housing represents a particularly acute

What is senior living investment, and why consider it?

Senior living investments involve allocating capital to communities providing housing and care for older adults, including independent living, assisted living, memory care, and continuing care retirement communities (CCRCs). At Haven, we view these as Redemptive.

What makes senior living a compelling investment?

Investing in senior living offers durable financial returns, stable occupancy due to growing demand, potential capital appreciation, and consistent cash flow. It’s an opportunity to generate income while positively impacting the lives of seniors and their families.

Which types of senior living facilities can I invest in? You can invest in:

Independent Living (IL)

For active seniors needing minimal assistance.

Assisted Living (AL)

For individuals requiring help with daily activities but not 24/7 medical care.

Memory Care

Specialized support for those with Alzheimer’s or other dementias.

Continuing Care Retirement Communities (CCRCs)

Offer a range of care levels, from independent living to skilled nursing, all on one campus.

Skilled Nursing Facilities (SNFs)

Provide round-the-clock medical and rehabilitative care.

How do I begin investing passively in senior living?

Start by reviewing investment opportunities offered by experienced sponsors like Haven. Evaluate market research, financial analyses, and partnership structures. Passive investments typically involve syndications, REITs, or dedicated funds managed by senior living

What risks should passive investors consider?

Common risks include regulatory changes, market saturation, operational complexities, and economic downturns. Haven prioritizes mitigating these through meticulous due diligence and operational expertise.

What is an accredited investor, and must I be one?

An accredited investor typically has a net worth over $1 million (excluding primary residence) or annual income above $200,000 ($300,000 jointly). Most private senior living investments require accredited investor status per SEC guidelines.

How exactly does passive investment work in senior living?

Passive investors contribute capital without daily management responsibilities. Investment structures include:

• Syndications

• Real Estate Investment Trusts (REITs)

• Managed Senior Living Funds

What should I evaluate before investing in a senior living project?

- Strong operator track record: Seek experienced, reputable teams with strong operational and financial performance.

- Favorable location demographics: Analyze demographic trends, competitive landscape, and demand indicators.

- Solid financial health: Review cash flow projections, debt structures, and reserves.

- Regulatory compliance: Confirm that state and federal regulations are met or exceeded.

- Clear growth strategies: Assess room for expansion, renovations, or additional care offerings.

How is technology enhancing senior living investments?

Technology like telehealth, smart-home features, and electronic health records (EHRs) improve resident care, operational efficiency, and investment value.

Are there tax advantages to senior living investments?

Yes, advantages include depreciation, mortgage interest deductions, 1031 exchange opportunities, and strategic capital gains management. Consult your tax advisor for personalized advice.

How can I track my investment’s performance?

Key metrics include Occupancy Rate, Net Operating Income (NOI), Revenue per Available Room (RevPAR), and resident satisfaction scores.

Can I invest if I'm not accredited?

Non-accredited investors can participate through publicly traded REITs or regulated crowdfunding platforms specializing in senior housing.

What lease structures are common in senior living?

Lease structures often include month-to-month agreements and entrance fee models, particularly in CCRCs.

How does the level of care influence returns?

Higher care levels like memory care or skilled nursing generate higher revenue but incur greater operational costs and regulatory complexity. Independent and assisted living typically have lower costs with stable returns.

Does government funding impact senior living investments?

Yes, Medicare and Medicaid reimbursements affect revenue streams, particularly in skilled nursing and memory care facilities. Changes in policy can influence investment risk.

What happens when selling a senior living property?

Sales involve regulatory compliance, licensing transfers, and maintaining resident and staff continuity to preserve property value.

What maintenance and capital expenditure considerations exist?

Regular maintenance sustains property value and satisfaction, while strategic renovations can significantly enhance revenue potential.

How important is insurance in senior living investments?

Insurance coverage, including property, liability, and specialized healthcare policies, is crucial to managing risks effectively.

How does staffing impact senior living investment success?

Proper staffing affects care quality, occupancy, and overall profitability. Effective staff retention strategies are vital.

What design trends influence senior living investments?

Emerging trends include wellness amenities, smart technology integration, and AI-driven care solutions enhancing resident experience and operational efficiency.

How do I assess competitive market conditions?

Analyze demographic growth, local competition, occupancy rates, pricing, and regulatory trends.

What exit strategies exist for passive investors?

Common strategies include asset sales, mergers, and utilizing 1031 exchanges for tax-deferred reinvestment.

How do healthcare policy changes affect investment outcomes?

Policy shifts impacting Medicaid and Medicare reimbursement, along with state-level regulatory adjustments, can influence investment performance.

Does sustainability matter in senior living investments?

Energy-efficient and certified green buildings reduce costs and appeal to environmentally conscious investors and residents.

How do I align senior living investments with ethical goals?

Choose operators prioritizing resident-centered care, employee satisfaction, and environmental sustainability.

Can I invest passively in senior living?

Yes, through syndications, REITs, and managed funds that require no direct hands-on management.

What questions should I ask before investing?

- Does this investment align with my financial and ethical goals?

- Is the market stable with strong long-term demand?

- Does the sponsor have a proven track record?Regulatory compliance

- What protections mitigate downside risk?

- What is a realistic timeline for returns?